Introducing

Credit Pulse!

Your one-stop solution to track, understand, and grow your credit score.

What is Credit Pulse?

Credit Pulse is a set of smart tools designed to help you improve your credit score over time. By combining credit score monitoring, a credit score simulator, and insights into key score factors, it helps you understand where you stand, what’s affecting your score, and how you can make better financial decisions.

With regular tracking and actionable tips, Credit Pulse puts you in control of building a stronger credit profile

Why is credit score important?

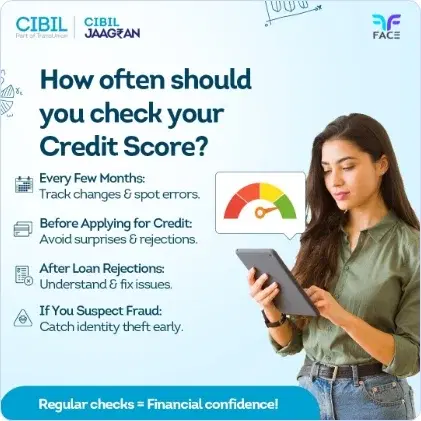

A strong credit score plays a key role in shaping your financial journey. It influences everything from premium credit approvals to loan interest rates and repayment terms. A good credit score reflects reliability, giving lenders the trust to offer better terms and faster approvals. Regular credit score check routines — especially through a free credit score check online — helps you stay aware and in control. In high-value financial decisions, your score often speaks before you do.

Benefits of credit Pulse

Stay ahead of credit decisions

Improve credit score with timely insights

Strengthen loan eligibility over time

Monitor progress toward a high score

How to avail Credit Pulse?

Download the Kissht app from Google Playstore

Avail a Personal Loan on the Kissht app

Select Credit Pulse when you pay your first EMI

Get ready to monitor & boost your credit score!

Credit score range and meaning

800 - 900 | Excellent

Reflects top-tier financial discipline; highest approval chances.

750 - 799 | Very good

This CIBIL score range often leads to faster approvals.

700 - 749 | Good

Good credit score helps getting loans at moderate terms.

650 - 699 | Fair

Limited creditworthiness; may face rejections.

300 - 649 | Poor

Low CIBIL score indicates weak credit history; improvement needed.

Kissht x FACE x CIBIL

We are proud to support FACE and CIBIL in their efforts to safeguard customer interests and promote financial education for today's digital-first borrower.

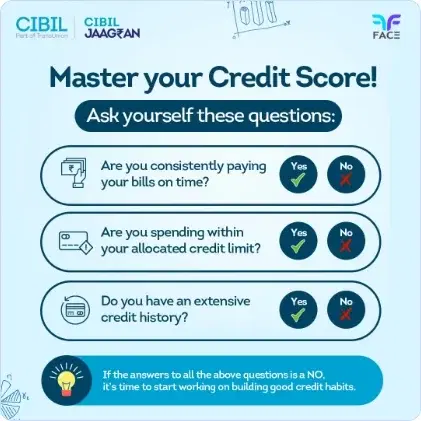

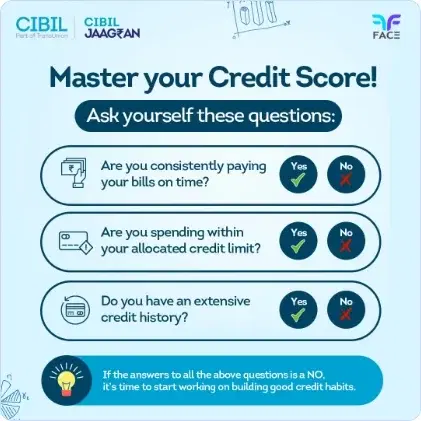

How is credit score calculated?

Your credit score is calculated based on factors like your repayment history, credit utilization, length of credit history, types of credit used, and recent credit inquiries. Timely payments and low outstanding balances help build a strong score, while delays and frequent borrowing can bring it down.

Factors that affect your credit score

Repayment history: Timely payments improve your credit score, while missed payments lower it.

Credit utilization: Moderate usage of your available credit supports a good credit score.

Account age: Longer credit histories generally result in better CIBIL scores.

Credit inquiries: Frequent loan or card applications can reduce your score.

Credit mix: A balance of secured and unsecured loans can strengthen your credit profile.

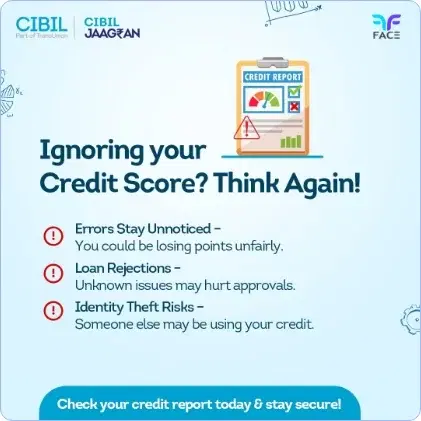

Common reasons for a low credit score

Missed payments: Failure to pay on time can bring your credit score down.

High credit utilization: Overuse of your available credit can reduce your credit score

Short credit history: A new or thin credit history may result in a lower credit score.

Too many inquiries: Multiple loan applications can signal financial stress, lowering your score.

Unsettled debts: Unpaid loans or defaults can significantly damage your credit score.

How to improve credit score?

Maintain financial discipline

Consistent repayments reflect well in your credit report.

Reduce outstanding debt

Limit credit utilization to support credit score improvement.

Avoid frequent borrowing

Minimizing new credit requests protects your credit score

Use a balanced credit mix

A healthy blend of loans improves your CIBIL score.

Focus on long-term credit health

Good habits over time lead to a high credit score.

Frequently Asked Questions?

Credit Pulse is an add-on feature that helps you track and improve your credit score. It becomes available when you take a personal loan and can be activated while paying your first EMI.

You can choose Credit Pulse while paying your EMI. A small one-time fee will be added for the feature. It stays active for 1 month, until your next EMI. To continue, you’ll need to opt in again with every EMI payment.

With Credit Pulse, you can monitor your credit score progress, use the simulator to predict how financial decisions affect your score, and get personalized tips to boost it.

No, Credit Pulse itself doesn’t affect your score. It provides tools and insights to help you make informed decisions that can improve your credit score over time.

No, it’s completely optional. You can choose to activate it for added support in managing and improving your credit health.