Why ChooseKissht?

Flexible

Repayments

Instant

Approvals

Lower Interest

Rates

Quick

Disbursals

100% Paperless

Process

Minimal

Docs

Flexible

Repayments

Instant

Approvals

Lower Interest

Rates

Quick

Disbursals

100% Paperless

Process

Minimal

Docs

OurProducts

Loans

At Kissht, we offer a wide range unsecured loans with quick approvals and minimal documentation, as well as secured loans like Loan Against Property (LAP) for higher amounts at competitive rates. Enjoy easy approvals, fast disbursals, and flexible repayment options tailored to your needs.

How to apply forloan?

EligibilityCriteria

Nationality

Indian citizen

Indian

citizen

Age

Between 21 and 60 years.

Between 21 and

60 years.

Documentation

Selfie, PAN Card, and Aadhaar Card.

Selfie, PAN Card, and Aadhaar Card.

Profile

Salaried, Self-Employed, Small business owners & MSMEs.

Salaried, Self-Employed, Small business owners & MSMEs.

OurCampaigns

Watch our latest campaign

#Legendary Speed, Legendary Trust

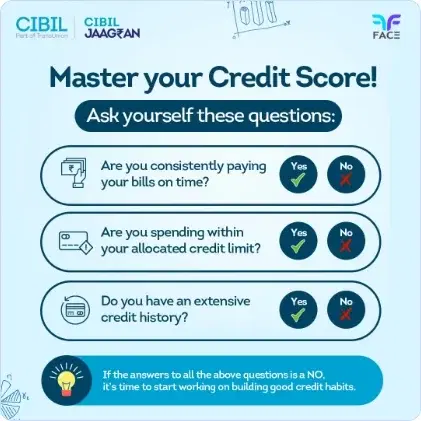

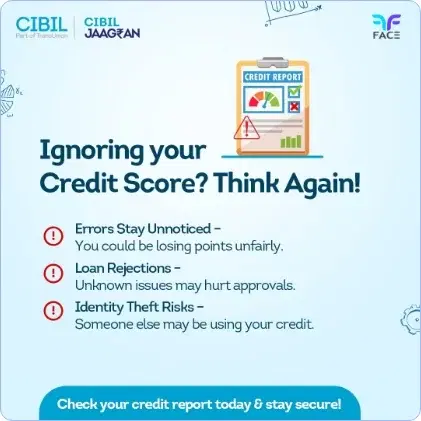

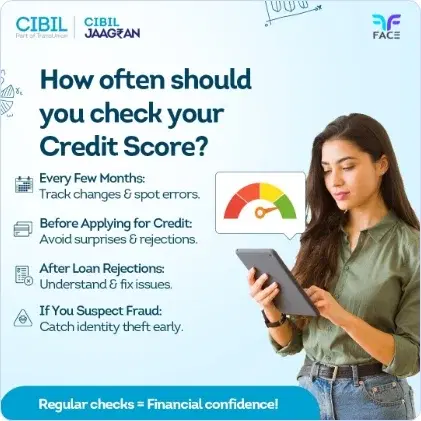

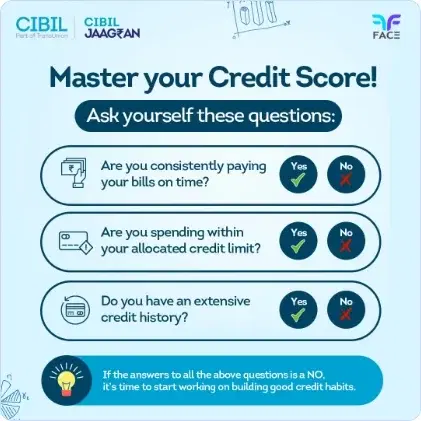

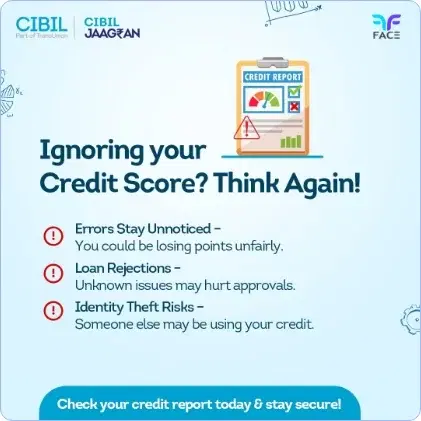

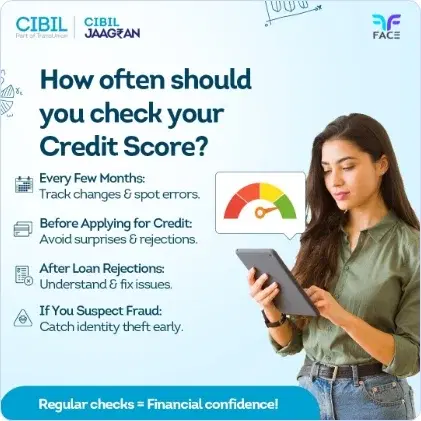

Kissht x FACE x CIBIL

We are proud to support FACE and CIBIL in their efforts to safeguard customer interests and promote financial education for today's digital-first borrower.

OurHappy Customers

"I needed money urgently and was worried about long processes, but Kissht made it so simple. I applied, and within no time, I got the money I needed."

Anjali M

"I always thought getting a loan would be difficult because I don’t understand big bank rules, but Kissht made everything so simple. I applied easily and got my loan instantly. The convenience in applying just makes the experience better"

Amit K

"Before my salary came, I had a sudden expense and didn’t know what to do. Kissht helped me get the money quickly without any long forms or complications."

Hitesh

"Everywhere else, I had to submit too many papers and visit offices, but with Kissht, I got my loan without running around. It was quick, simple, and stress-free."

Nikhil

"I needed money urgently and was worried about long processes, but Kissht made it so simple. I applied, and within no time, I got the money I needed."

Anjali M

"I always thought getting a loan would be difficult because I don’t understand big bank rules, but Kissht made everything so simple. I applied easily and got my loan instantly. The convenience in applying just makes the experience better"

Amit K

"Before my salary came, I had a sudden expense and didn’t know what to do. Kissht helped me get the money quickly without any long forms or complications."

Hitesh

"Everywhere else, I had to submit too many papers and visit offices, but with Kissht, I got my loan without running around. It was quick, simple, and stress-free."

Nikhil

Finance Blogs

Frequently Asked Questions?

• Selfie • PAN Card • Aadhar Card (Address Proof)

To complete Digital KYC, only your Aadhaar Card & PAN Card are required.

Income Proof is not required for all customers. Only for some high-value loans, depending on customer’s credit profile, he/she may be asked to submit Income Proof by linking his bank account or via PDF Bank statement so that the bank statement can be fetched & verified online.

No, we do not require any security or guarantor to approve your loan. Once we verify your basic information & complete your digital KYC, your loan will be approved by the system, based on profile eligibility.

Once you have paid all your EMIs and outstanding dues, we will send you a No Objection Certificate (NOC). The NOC will be sent to your registered email id after 72 hours (3 days) of closing your loan account.

OurAchievements